You can have a precise idea of our Trading Performance in three different ways. We do our best to provide an honest opportunity to see how we work and how we trade

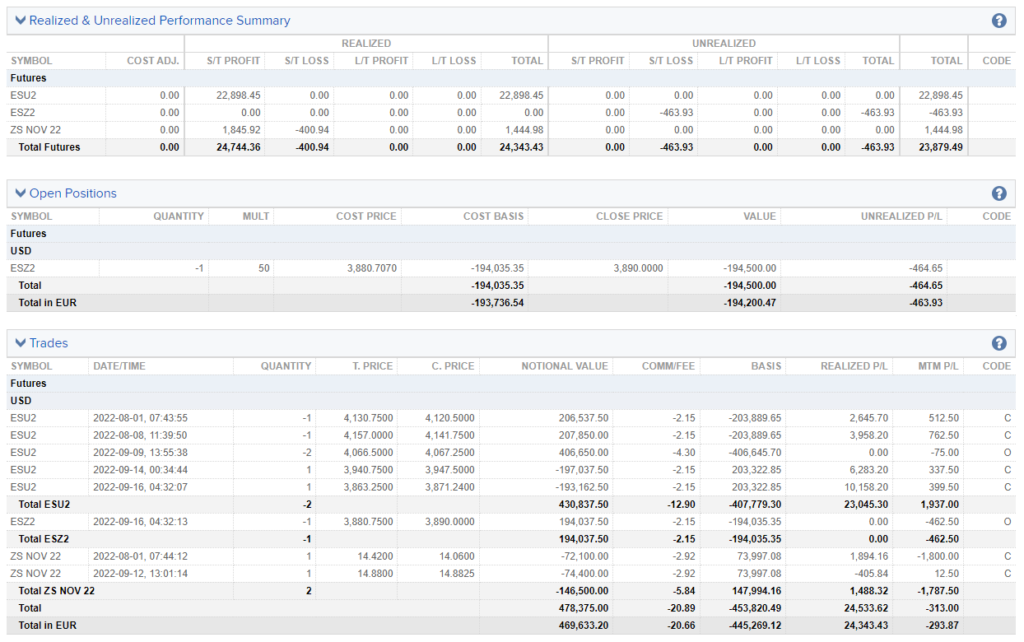

1 – Activity Statements of real-time trades posted on our Blog

We provide Activity Statements through our Blog, regularly, since July 2022. We simply follow the strategy we provide in our Daily Reports.

Click here to see the posts with the real-time trade

2 – Activity Statements where I turned 40.000 USD into 64.000 USD in three months

In 2013, I wrote an e-book for my Subscribers, to show them how to trade with my Reports. During these three months, I have saved the intraday charts every evening, showing all the real trades taken. After these three months, I had a performance of +58%, turning 40.000 USD into 64.000 USD. Real-Money Activity Statement from Interactive Brokers included, of course. You can have the E-book for free, Signing Up for my free Newsletter (I am offering for free an e-book that I used to sell, in the past).

3 – Strategy Performance of all our signals provided through our Daily Report Service

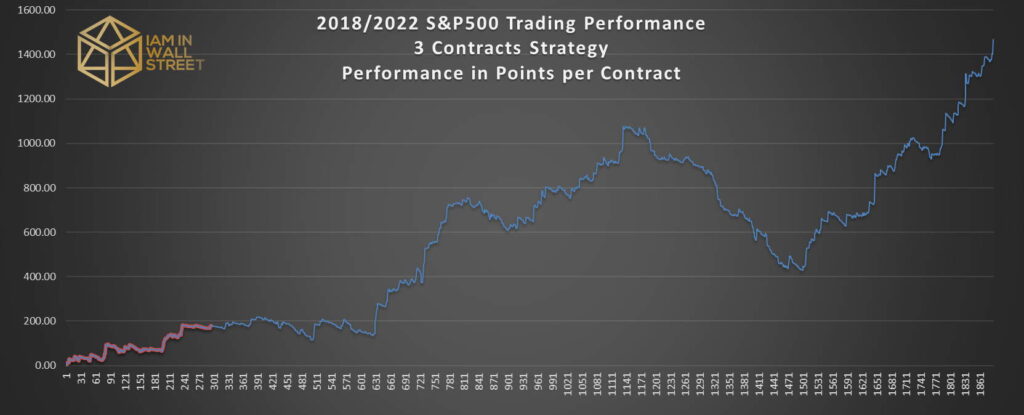

2018/2022 S&P500 Futures Trading Strategy Performance

In terms of points, trading with the Micro E-Mini S&P500 Futures, the strategy produced a profit of +11.000 USD from January 2022 to September 2022, working with 3 contracts at most (we use a strategy where we trade at most with 3 contracts or multiple). With the E-Mini S&P500 Futures, the strategy produced a profit of 112.500 USD during the same period. If you still do not believe in these numbers, simply look at the Statements from the Blog.

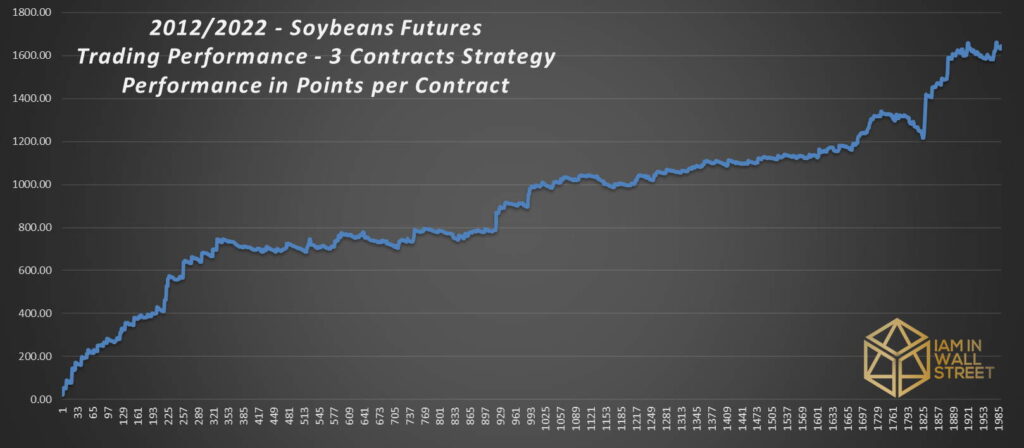

2012-2022 Soybeans Trading Performance

Our performance strategy with the Soybeans Market is another example that shows how we are able to remain consistently in profit over the years. If you look at my recent Statements, you see that I am mainly working with the S&P500, Soybeans, and Gold. Right now, these are the Futures Markets I focus on for my personal trading.

However, I keep up my analysis with other Markets like Corn, Wheat, 30 Years T-Bonds, Live Cattle, and Cotton.

In September 2022 we started providing THE IAWS CODE, a new service to help people to follow my work and my trading strategies even if they cannot follow the market during the day, thanks to a CODE that can trade for us.