- June 18, 2021

- Posted by: Daniele Prandelli

- Categories: Forecast, S&P500

The S&P500, and the Stock Market in general, have been a big surprise in the last months. I am not talking about the uptrend, but how it developed: no pullbacks, fast pace.

And this time, I have to admit that it surprised me too, despite my PFS Forecast Model nailed perfectly, again, the movements of the first half of 2021. Let me explain…

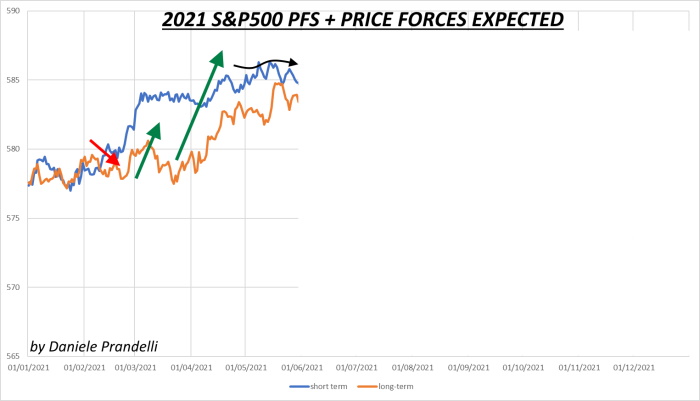

In December 2020, I published my 2021 forecast for the S&P500, as I do every year in my Annual Bulletins. Here below, you can see the first 6 months of the forecast, until now (keep in mind that this chart was provided in December 2020 to all the S&P500 Annual Bulletin subscribers; hence, it was created seven months ago):

If we compare the Forecast we published seven months ago to the actual Market, we can state that it was amazing:

The result of the forecast has been great! It nailed again the correct outlook, and I do not see any reason to see it stop working correctly. So, what’s next? Is the uptrend about to continue, after the sideways pattern of the last weeks? Or, is this the time for the end of the Bull?

If you want to know what my Forecast Model says about the remaining half of the year, you can: order the S&P500 Annual Bulletin here. If you are patient enough, you can wait for the first of July. The price of the 2021 S&P500 Bulletin will drop by -40%, considering we will be at half-year.

If you want a constant Update, daily or weekly, you can opt for the Daily Report or Weekly Report Service, where we cover several markets: S&P500, T-Bonds, Gold, Crude Oil, Corn, Soybeans, Wheat and Live Cattle.

Time to Confess

And now, the painful part of the post. I am always honest, for better or for worse. Everyone who knows me is aware that I do not hide when I make a wrong forecast; or when I have some losses with a Market. I strongly believe that losses and wrong forecasts are fundamental parts of trading; it is impossible to be always infallible; we just have to learn how to go through hard moments. Well, despite the great S&P500 Forecast Model, I have had some troubles handling the S&P500 in the last months of the year. I was not expecting to see the S&P500 that strong! Other independent cycles were suggesting to me that the S&P500 could stop the uptrend in advance; in 2020 I did foreccast a very strong Bull until November 2020, which was my favorite month for the end of the Bull. I was wrong, damn wrong! Shame on me! I have been stubborn believing that I could be right despite the PFS Forecast Model was evidently telling me that the time for the downtrend was not there yet. However, I strongly believe my revenge is just over the corner. If you want to know how I am planning to make good profits in the next months, the subscriptions are available.