- August 13, 2018

- Posted by: Daniele Prandelli

- Category: Trading

This is the Trading Performance of our Futures Strategies since the first of January 2018

The strategy that has produced these results are provided in our Daily Report Service, with precise rules where to put stop-loss, take-profits and entry orders. These trades are also documented LIVE through our Screen Sharing Service – No cheating – Nothing to hide – Our subscribers know that.

We are showing the trading performance of each Futures Market we trade. We are happy (and proud) to tell that we are in profit with every Futures Market we trade, even in Markets that are negative since the beginning of the year.

E-Mini S&P500

This is the Market where we put most of our efforts, and you can appreciate the results. We did not suffer the crash of February, and we maintained a positive trend in our trading strategy performance. Regardless the choppiness of the S&P500, our trading activity remained always under control, with no large drawdowns.

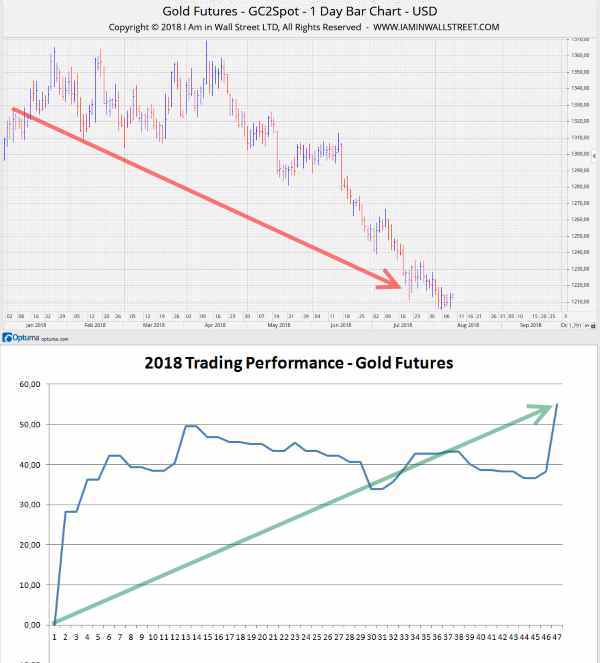

Gold

We are doing a great work with Gold, trading with patience and always waiting for the best levels, where our strategy provides a favorite risk/reward ratio. The chart is self-explanatory, we are beating Gold!

30 Years US T-Bonds

We had some troubles at the beginning, but we covered the losses with some good trades, always opening LONG positions. This Market is very negative since the beginning of the year, but our trading strategy has a positive performance at the moment.

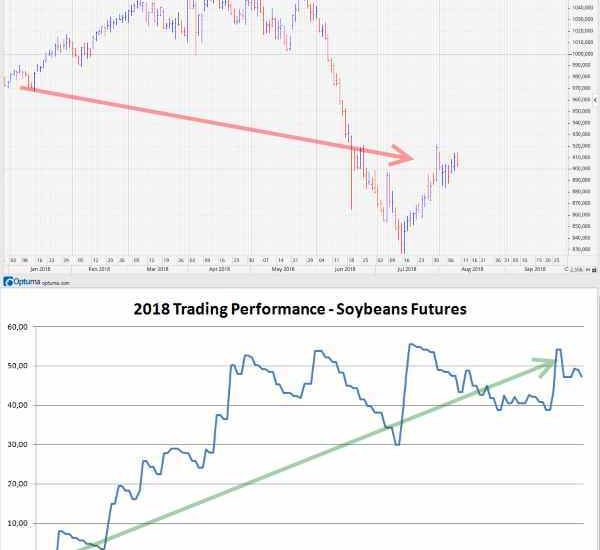

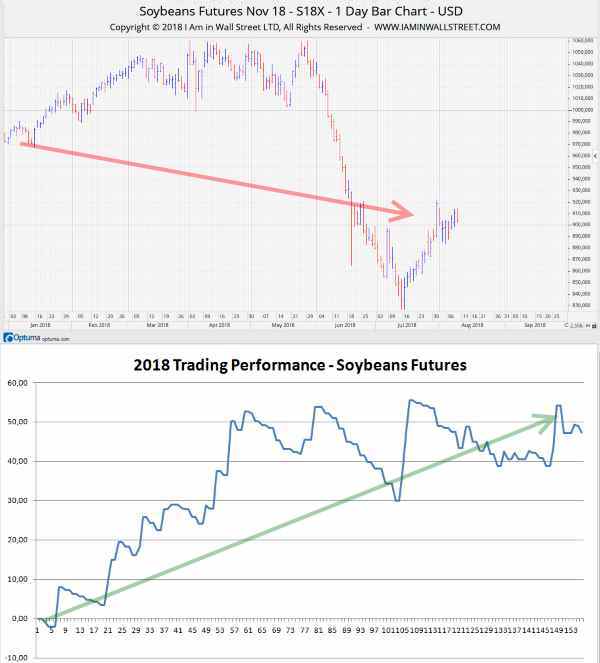

Soybeans

We are beating the Soybeans Market, with an excellent positive performance, while Beans are strongly down since the beginning of 2018. It was not easy because Soybeans began a strong downtrend two weeks before we planned to open SHORT positions. The trade-war ruined our plans, otherwise the performance would have been much more positive.

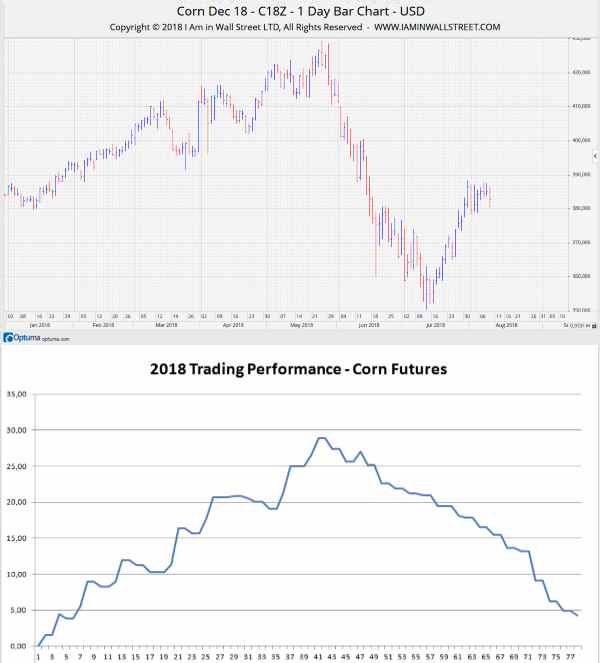

Corn

The Trading Performance with Corn is producing the lowest performance between the Futures Markets we trade. Despite the good forecast until May, we suffered the descent, and we have not been able to open new SHORT positions in the summer due to tricky movements that did not allow us to trade with confidence. This is not a book, we do real trading, and dealing with the real Market is not easy. Too bad, because we did forecast a descent from June, but the descent began in May.

Despite the hard conditions, we are still in profit (even if a little one), thanks to a strategy that always cuts the losses and lets the profits to run.

Wheat

The chart is self-explanatory; we are doing a good job with Wheat, and we are trading it with good profits. Thanks to a precise price map, we always found good levels where to open LONG positions safely, always using tight stops.

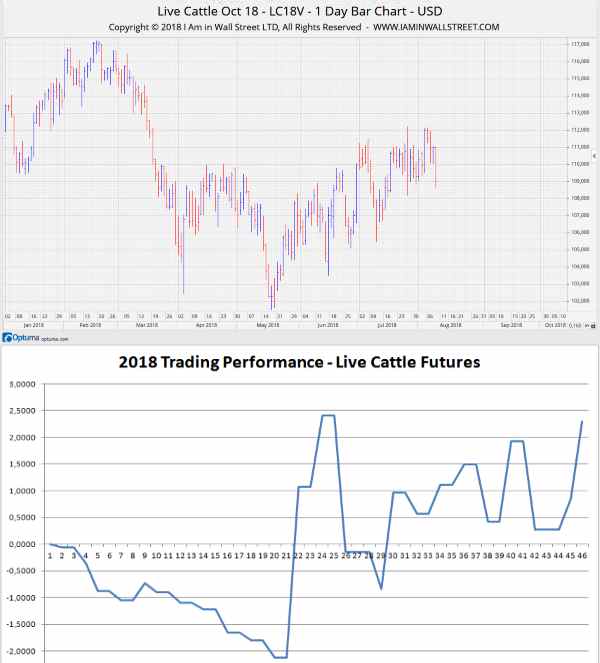

Live Cattle

Live Cattle is another Commodity that is in negative since the beginning of the year. Despite the negative trend, we are in profit with Live Cattle. Let me tell you that trading this Market has been very tough, so far! Live Cattle remained choppy for months, with strong daily accelerations, recovered often during the days after. Choppy is not good, above all for our strategy; however, analysing the Market with honest eyes, and being aware of the limits we have, we changed a bit the strategy, and it is working!

Conclusions

We keep up our work, and we are happy to see that hard work gets rewarded. After 18 years of experience, we know that this performance is the result of a few important skills, hard to find in anyone: discipline and patience. All these strategies are provided, with precise signals, in our Daily Report Service.

And let me tell you this: we prefer to show the real results of our strategy instead of showing how Timer Digest ranked us as forecasters (we are not in the Timer Digest program)! We are not here to forecast, we are here to trade and make profits, which is a totally different story. I let you guess, while I trade.

While people still doubt our work, we provide also a Screen Sharing Service included in the Daily Report Service, where subscribers can see, LIVE, every day, in real time, all the trades we take in the Futures Market:

- E-Mini S&P500

- 30 Year US T-Bonds

- Gold

- Crude Oil

- Soybeans

- Corn

- Wheat

- Live Cattle

I really do not know what we can do more than that! We accept a maximum of 30 subscribers to our Daily Report Service, there are still 7 subscriptions available.