- August 26, 2020

- Posted by: Daniele Prandelli

- Categories: Forecast, S&P500

In December 2019 I provided my 2020 S&P500 Annual Bulletin, with the 2020 forecast included as I do every year. Believe it or not, the Stock Market keeps following exactly what I planned to see. Here is how it is working so far

The PFS Forecast Model

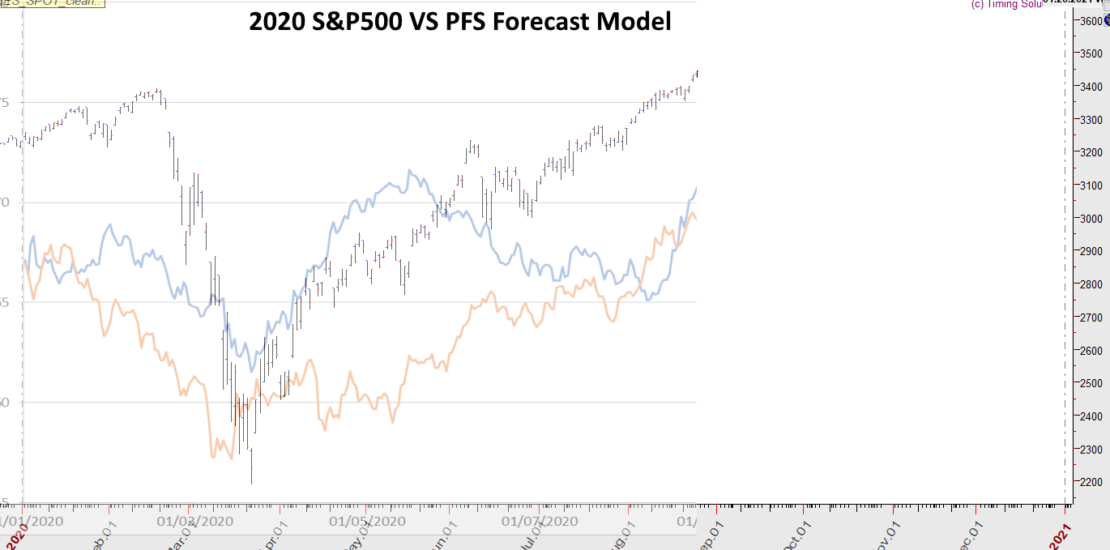

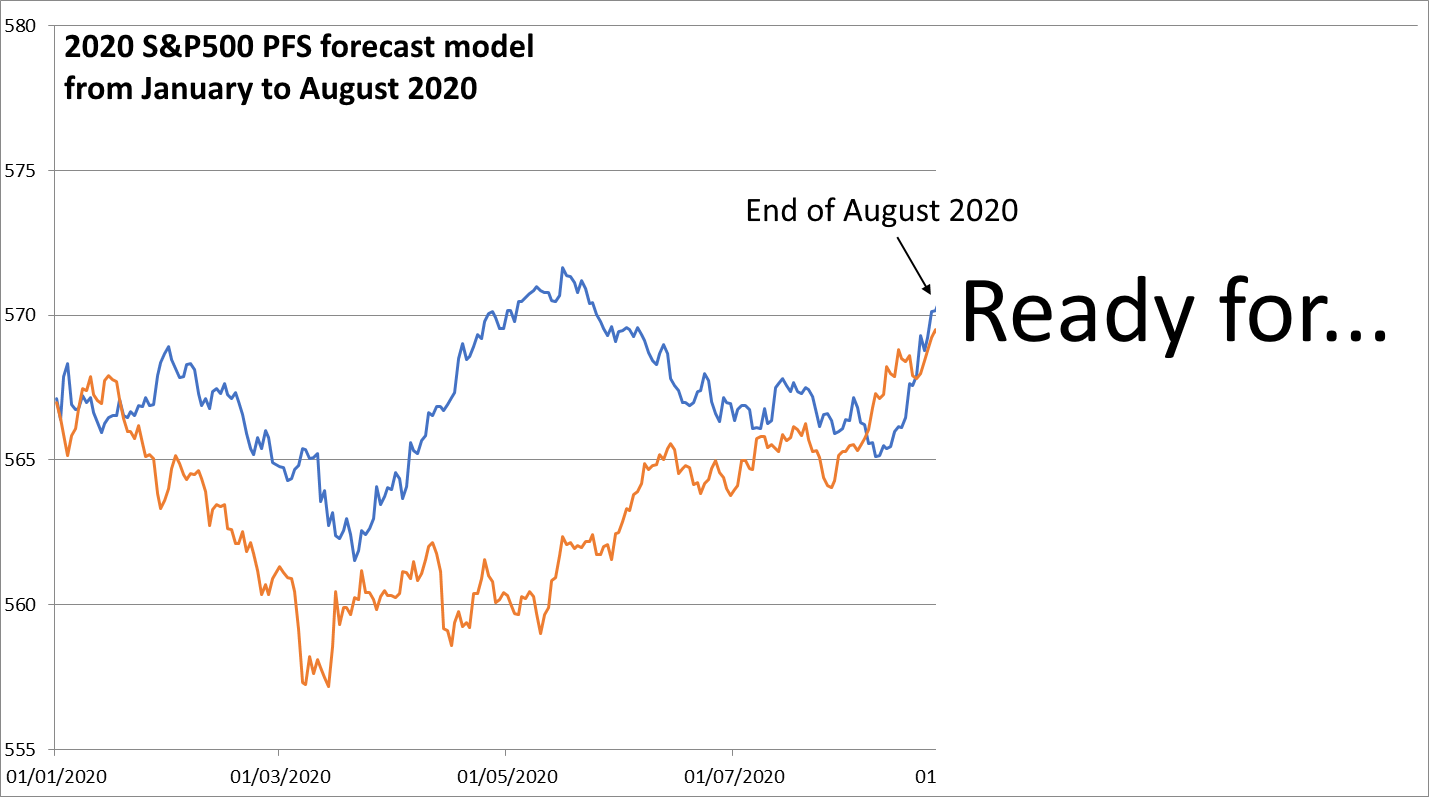

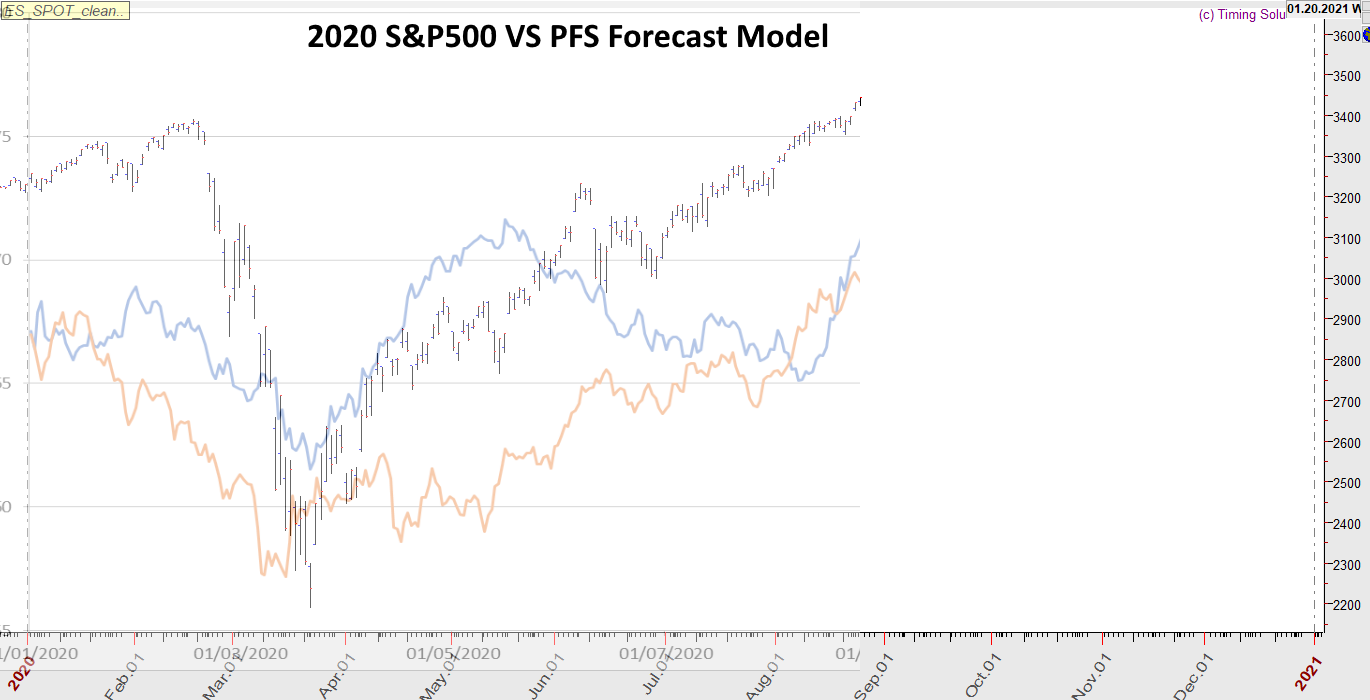

The PFS (Polarity Factor System) is a forecasting model that statistically provides the general trend of the year, and it is possible to create it years in advance. The 2020 S&P500 forecast model was issued in December 2019, and this is what it suggested from January to August 2020:

If we compare it to the 2020 S&P500 movement so far, the model has been able to not just forecast the descent until March, but also the strong bull market from March to August:

Do not forget that the PFS model was created one year in advance!

The Annual Forces

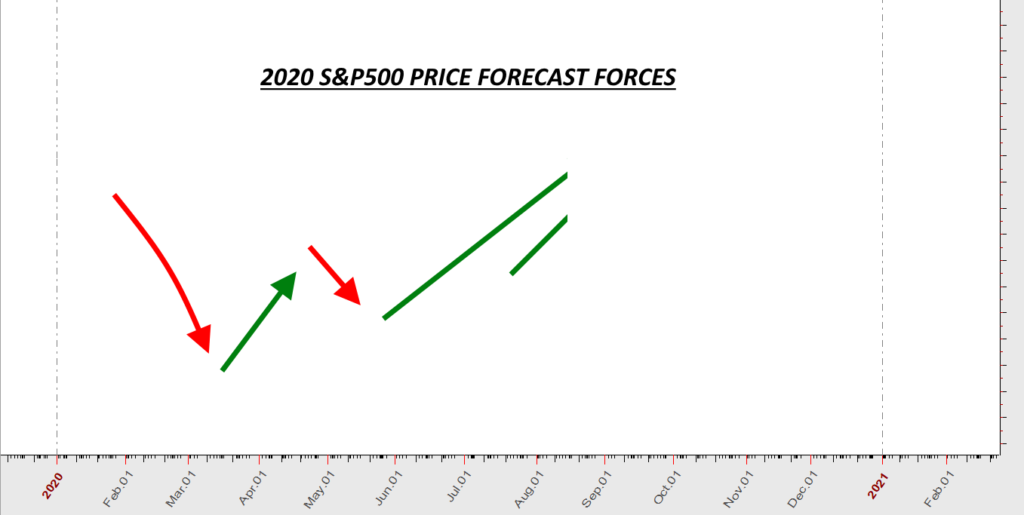

In the 2020 S&P500 Annual Bulletin, I have also provided the forces that statistically should forecast the timing of up pressure and down pressure of the 2020 Stock Market, here it is from January to August:

This chart too was provided in December 2019, where I said to expect a descent until March, then up until April, little pause and new strong up push from May. What next? I do have already the answer (statistically speaking, because I am not always 100% right). Are we about to see the end of this strong Bull market or we can keep following it safely?

Cycles work if you know how they act

The concept of cycles has a huge debate in trading; there is who believes it, who does not; however, before to ask if cycles work, we should ask: what is a cycle? There are many methods using cycles, and I believe that not all of them are reliable; second, we have to know the limits of using cycles, because we cannot think that cycles work always in a perfect way. As every study made to create a forecast, also the cycles are based on statistics, which means that they should work most of the time but not every time. Can we time the market? I think that the Charts here above speak for themselves: yes, we can! But it does not mean that they work every time in the way we hope! So, if you want to study the cycles, stick with the reality of what information they can provide to you, without hoping to become God.

Through the www.cosmoeconomics.com website, it is possible to learn how I build the PFS Forecast Model for the S&P500; the PFS is one of the most important tools that I use to create my forecasts, and this Course is available. Yeap, it is a little expensive, I know. However, I do believe that the 2020 Forecast worth much more than 3000 USD, do not you think? What if you knew this forecast in advance?

If you are not ready to spend 3000 USD for a course, you can always test my work, subscribing to my Daily or Weekly Report Services, or subscribing to the softer Annual Bulletin, now half-priced.