- November 15, 2022

- Posted by: Daniele Prandelli

- Categories: Accounting, Gold, S&P500

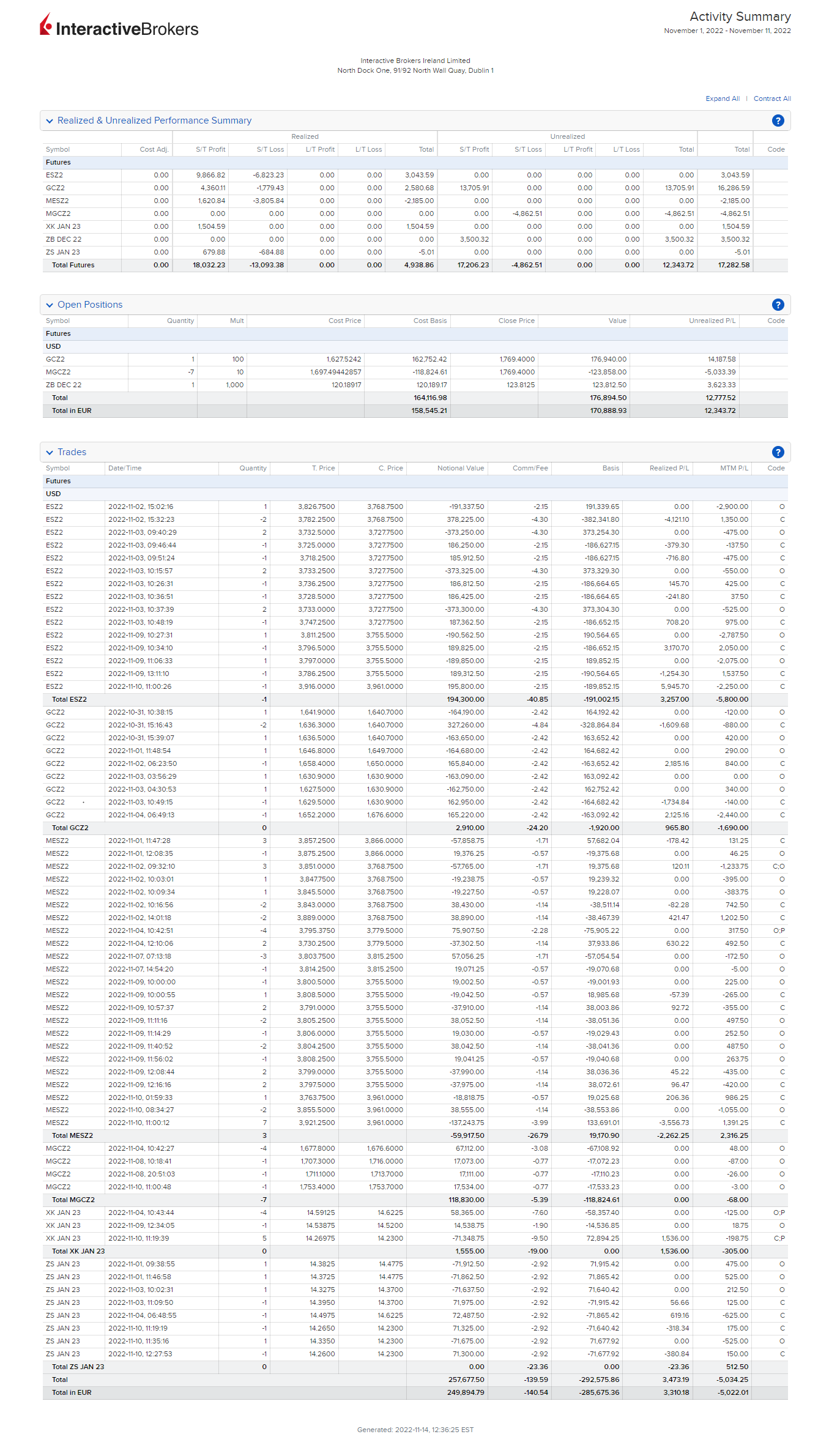

October 2022 has been such a tough month, but working with discipline and cutting the losses when we had to, now we can see the clear result: profits. Well, between October 31 to November 11, we realized a profit of 4,938.86 EUR and we still have positions open and in profit of 12,343.72 EUR. It means that, in the last two weeks, we were able to end up with a total profit of 17,282.58 EUR.

How? It was not easy… but it was easy! The big role of this performance was played by our forecast and timing analysis; we “knew” the S&P500 was about to turn bullish from the last week of October, and we “knew” the Gold price was about to take off. How did we know it? That’s because we work with forecast models (and not just with them; the analysis of the price is even more important once we set the final strategy).

I have attached here below the entire Statement with all the Trades, the positions still open up to Friday, November 11, and the Realized/Unrealized profits.

Sure we had some troubles during the previous weeks, above all dealing with the S&P500. It was so choppy, I had to take many little losses, plus, one bad loss at the beginning of October. I think I could have done better, but we know, real trading is not a game played with cards on the table. As I always say, the final result is the only thing that matters. Since mid-July 2022, this account is in profit of about 48,000 USD.

Our work, starting from the Annual Bulletins to the Daily and Weekly Reports, is all we need to achieve these results. We plan the strategies and the forecasts in advance. I said one year ago that October 2022 was about to be a Low and a buying opportunity. What happened then? October 2022 became a Low and a buying opportunity! And that’s all I did to make me work with LONG positions and make profits! Same with Gold: I said in advance that the end of September was about to be the Key Date to open LONG positions if it turned out to be a Low; the end of September became a Low, and we have simply worked with LONG positions since then.