- March 2, 2020

- Posted by: Daniele Prandelli

- Categories: Forecast, S&P500

Is this the end of the bull market, or is this panic-selling going to be a great buy opportunity for Stocks?

I know, this is scaring. This is not a pullback, this is a panic selling.

I have a simple advice to be able to read this situation: look at what happened in the past when we have seen a fast and strong movement like this. You should check it. I did my own homework, and it is very hard for me to believe that this is not going to be again a great buy opportunity. We always have the feeling that what we experience now must be special, different than what happened in the past. Then, we look at the past and we see how many times we see similar patterns. So, should we panic? I guess it is better we do not panic at all, but we use our time to read the actual pattern.

The coronavirus seems to be the real reason of this panic-selling. Do you know the real numbers behind this virus? I am sorry, I do not see how this virus can really stop the economy of the entire world. I am not an expert about it, but it seems more like an obsession than a real catastrophic situation. It is a matter of time, and all will be solved. Then, what will be the excuse to justify the markets at -20%? It is hard to believe that this is not going to be a buy opportunity, but we must be disciplined and have a precise strategy to take advantage of it, and protecting the positions in case we are wrong.

We will see if I am reading this situation in the correct way or not. However, planning a strategy in trading does not mean that we follow our point of view, or opinion. We have charts and the price never lies.

How did I handle this panic-selling?

I did not SHORT the Market, despite I was expecting a descent from the end of January until March. I preferred to follow the uptrend because it was very strong, and it gave us huge profits in 2019.

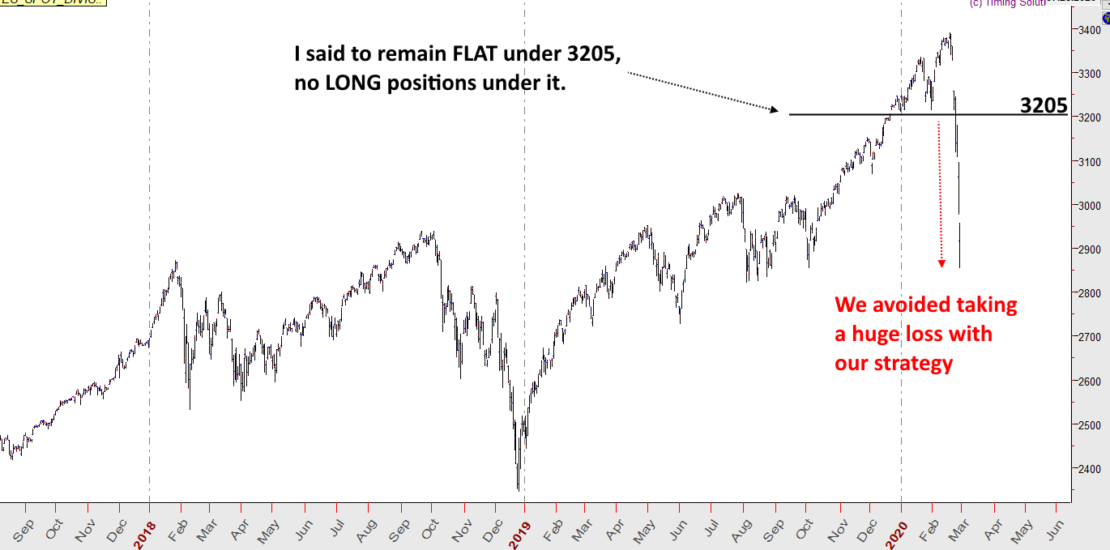

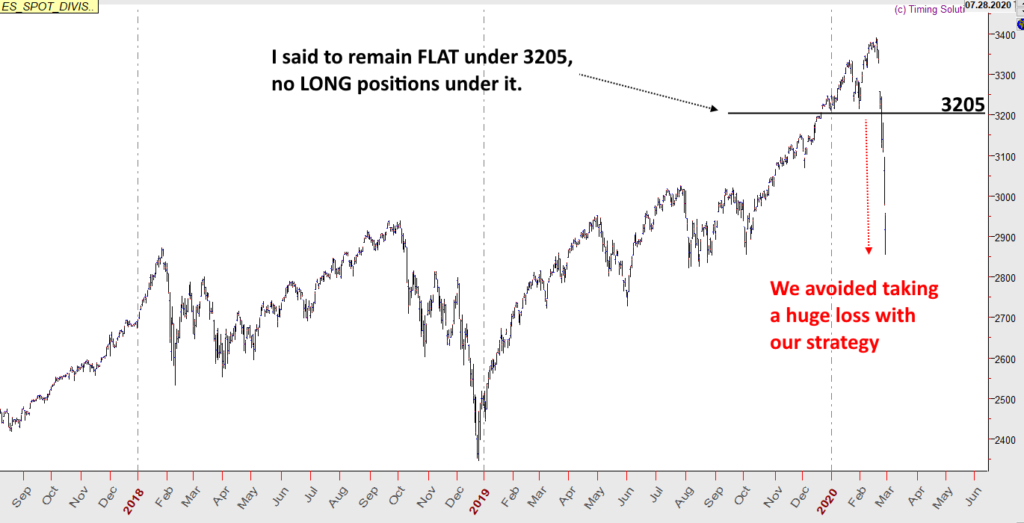

I provided a very important level where I said that we could not be LONG in case of a breakout under it. This level is at 3205 Futures Points of the E-Mini S&P500. So, it is absolutely not bad, considering that the S&P500 is now at 2950 points. We have protected the profits we made in 2019 with a very precise strategy.

If you want to know the reason for the strategy, and how to use it to make profits in the future, I explain it in a Special Update that I sent to my subscribers. With this strategy, you could also follow the downtrend, and I gave this strategy in December! Subscribe now to the Daily Report Service or to the Weekly Report Service and you will receive this strategy, simple and clean.

How to handle the actual Market?

The volatility is high, hence, the Market is not going to be easy. I do have again a precise strategy. I have a potential precise timing to know when we have to buy to take advantage of a bounce that has to happen.

For sure, we have to accept the risk of trading with high volatility. On Friday, February 28, there has been a 15-minute bar that moved 90 points in the S&P500! can you imagine it? It is so much! When the volatility is so high, trust me, it is very easy to take very bad losses! Much more than making big profits because it is very stressful.

Daniele bonsoir. I have just received your newsletter and am a little surprised to read your December forecast: I provided a very important level where I said that we could not be LONG in case of a breakout under it. This level is at 3205 Futures Points of the E-Mini S&P500. My wife and I subscribed to your Gann For Real signal at the end of December, and since then we have lost 60% of the initial capital, which was €7250. This is by far the worst performance of all my trading accounts; I cut losses on several positions manually and have now stopped the connection to SIGNALSTART to save what’s left, about $2,880; so we’ve lost a total of $4,370, plus the SIGNALSTART subscription fee of about $300. In times of great panic, it seems to me that it would have been wise to reduce leverage and position sizes as well as the frequency of trading, I don’t understand your approach which seems to only work in highly bullish markets.

We are prepared to continue to follow you with reduced exposure to the signal but without paying the subscription for the rest of the year. What are you proposing? Thank you, Jean Michel Renaudin, Paris, France

Hi Jean,

I am sorry to hear that you lost following the signal with CFDs. That was an account that started with 400 Euro, trading with a high risk to multiply the account (now at 700 Euro). But there is a reason if I never suggest trading CFDs: when conditions become hard, it is easy to lose money because of the spread, and that happened to me. Yes, I have lost in the last month with the CFD account, and I am not happy about it, but the account reached +280% in less than one year, so, it meant that the risk applied was very high. You probably subscribed to the signal right when the account was at the top. Honestly, I am sorry about it. My main strategy is for Futures Markets, not for CFDs. Applying my system to CFDs, it does not work that well. Then, of course, I am aware I did not handle the situation in the right way (I was not expecting at all this crash). I am thinking to close that account because it is hard to follow both CFDs and Futures accounts, above all when the situation becomes hot as it has happened in the last month. For me, the CFD account was just a challenge.

If you still want to follow the signal, I will leave it open and I will try to return to where you were with your money, I have to make another +100%, I think I can do it, but I cannot promise anything, you decide to copy, there is always the risk. I hope you understand. About the payment, no problem about that, but I do not know how to do it. How can you copy without paying? Please, contact me via email, you can find my contact in the “Contact Us” page.

Anyway, be aware that high performance requires high risk. That account is now at +75% in one year. I made +280% and I lost 60%, which can happen if I work to make +100-200% per year. I think people should not invest that much in someone else’s strategy, above all when the risk is that high. I would not do it. Another important thing is: if someone does not want to lose more than 20%, for example, that person should just stop copying once he reached a 20% loss. Not accepting the risk means that we do not understand the game.

About the strategy provided to my Daily and Weekly Report subscribers, this is a different thing, and yes, I did provide that simple strategy to protect the trade, a strategy used for Futures. As I said about the CFDs account, that was supposed to be a High-risk trading approach, different than what I provide to my Report Subscribers. A high risk that has not paid back, of course, I do not deny it. It went well during the months before. I know that the CFDs account has had a very bad performance in the last month, and I am sorry about it.