- October 20, 2022

- Posted by: Daniele Prandelli

- Categories: Accounting, Forecast, S&P500

This year, we are seeing a very tough October, with high volatility and choppiness. We see the S&P500 at the same level as it was at the beginning of the month; in the meantime, we saw choppiness between 3500 and 3800 points! A 300-point yo-yo, that’s big!

I tried to prepare my subscribers for this October, telling them that we were about to see hard market conditions. We did very well at the beginning, working with patience; in the last few days, we had to take several losses. We are seeing an opportunity, but we must be patient, and try to use tight stops, even if it means taking several little losses in a row.

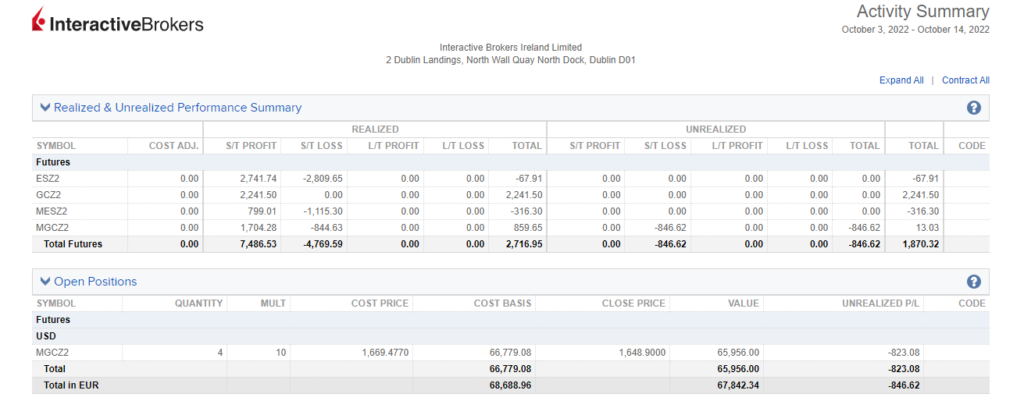

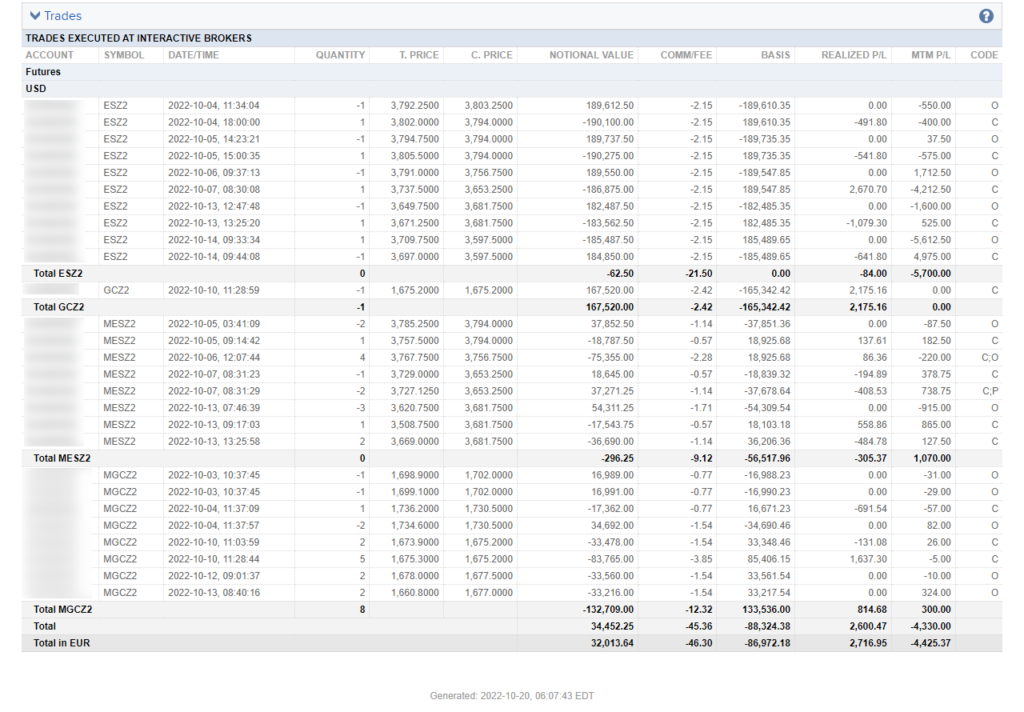

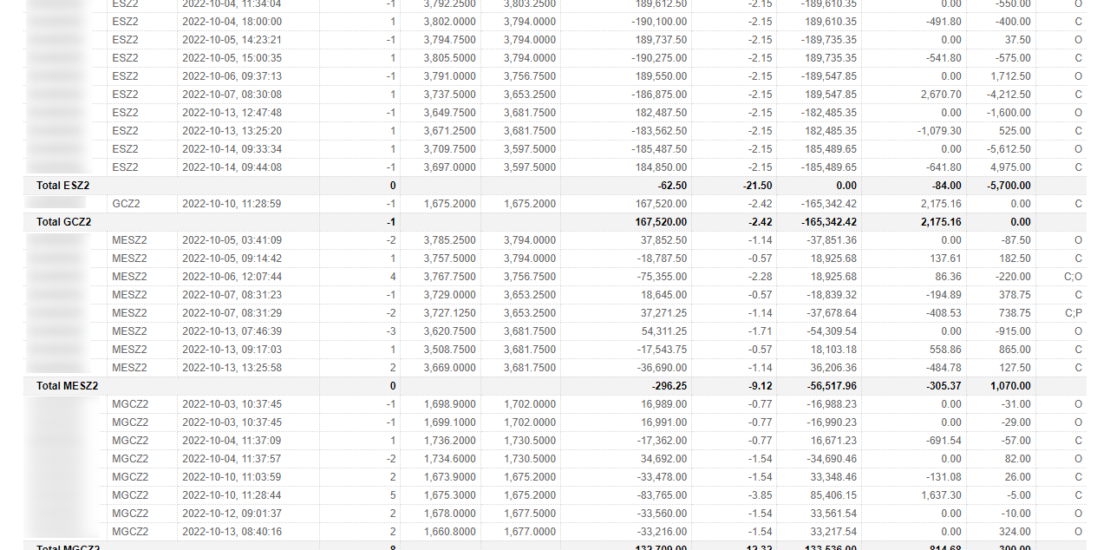

Unfortunately (or maybe, fortunately, because I personally avoided some losses), in the last week I have been working on a new project, and I could not follow precisely my favorite strategy. I did a kind of migration to MEXEM Broker, which is still Interactive Brokers, and I had to stop trading for three days, closing all the positions. In the end, in the last two weeks, I have had just a little profit (about 1900 USD of profit). However, let me be honest: if I traded my whole strategy, I would have had probably a loss of about 3000 USD. We remain in profit of about 30.000 USD since mid-July; tough periods are still part of the game.

Here below you can see the statement, with the positions still open (up to Friday, October 14), the Trades, and the Realized / Unrealized Performance.

This choppiness disturbed me; I had a quite precise plan to work with the date of October 10, with a high percentage of success, but this time, it did not work! Well, working with statistics, that’s part of the game; sometimes it does not work; nothing can work 100% of the time. And now, I see a potential intermediate Top on October 18-19. Would this setup bring the market to the time window I want to see as the BIG LOW? We will see…