- December 7, 2022

- Posted by: Daniele Prandelli

- Categories: Forecast, S&P500

The year 2023 is already in our hands, in our studies. We already know what to expect from the year 2023 because we have studied it and we are ready for it.

How can we be so confident? Because in 2022 we did the same thing, and it worked so great!

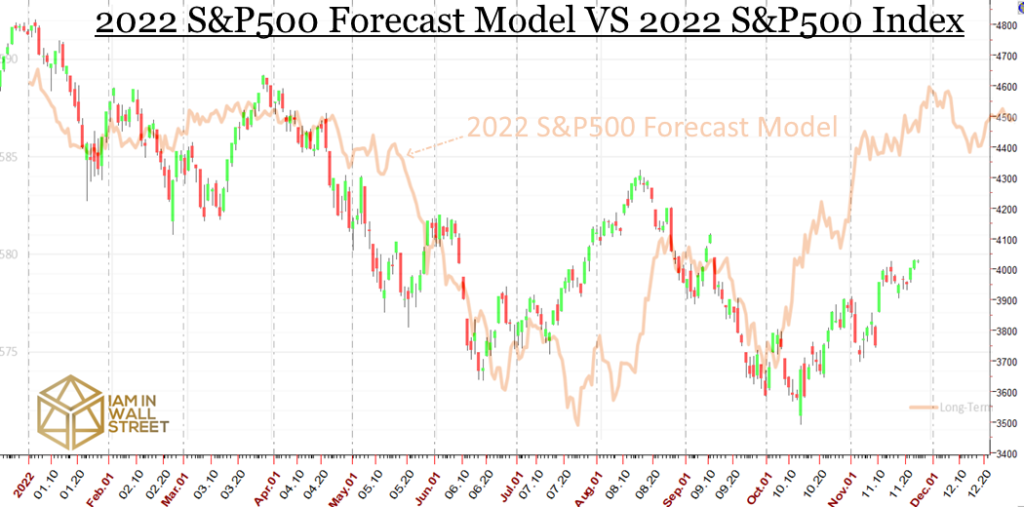

In 2022 we provided this forecast one year in advance. Look how it worked!

Yes, this is the PFS Forecast Model we provided to our clients in December 2021; now, we are providing the new 2023 S&P500 Forecast Model, which is already available in our 2023 Annual Bulletin.

Is the PFS Forecast Model a reliable tool to project the future?

The PFS Forecast Model is a tool I have developed to create a projection of the favorite movement the specific market is about to follow during the year. It is not infallible, but most of the time it is able to suggest the right trend to follow. It is a work based on statistics, very important for my analysis. The concept behind it brings much information that I use for my trading. You should be the one who judges my PFS Forecast Model. Click here to verify how the PFS Forecast Model has worked in the last years, not just with the S&P500, but also with Cotton, Live Cattle, Corn, and Soybeans Futures Markets.

2023 Annual Bulletins – a small price for a 12-months job

You can order the 2023 Annual Bulletins at this link. The Annual Bulletins Service is not just a cold projection of what we are expecting to see during the year. We provide a description of the expectations, plus, we send very important Updates during the year, to define precise strategies during Key Times.

Why should you trust my work?

Well, you do not have to, that’s up to you! But I do believe my work can help to judge how the market may move with a high probability to be correct, and when it should happen. A few points you should consider:

- I provide Activity Statements where we trade the market, following the analysis I do provide to my clients

- The 2013 E-Book “How to Trade to Make Profits” was written for my Subscribers to explain to them how to trade with my Daily Report Service, demonstrating that we turned 40.000 USD into 64.000 USD in three months, +58% real money, saving the intraday charts every day for the book, with a full Interactive Brokers Activity Statement (e-book available for free now)

- Past Reports and Bulletins are available to see how we have worked, nothing to hide

- Comments by Daniele Prandelli on Social Networks; we did bet on a big buying opportunity in March 2020, during the big COVID-19 crash, while everyone was in panic Comment 1 – Comment 2. Prandelli alerted people to NOT be negative

- On October 25, 2022, I made a public call about the 30-Years T-Bonds Market, which was literally falling down; I said that it was time to buy because a Low was imminent. The T-Bonds Futures did a Low on October 23, 2022, at 117.19; now Futures are at 131, in just 45 days. I rarely share public calls because I have Subscribers who pay for them.

But the most important thing is: how many people do you know that share Activity Statements?