2024 S&P500 Forecast and Strategy Bulletin

The 2024 S&P500 Forecast & Strategy Bulletin is available now. If you want to see the future, this is probably a good opportunity to know it with a high probability of success. Why can I say so? Because what we did in the last years suggests that we will be right again. Do you want to miss the 2024 S&P500 Forecast?

What does the 2024 S&P500 Forecast & Strategy include?

- The 2024 S&P500 Annual Bulletin, with a comment about what we are expecting to see during the year, how to approach it, and the most important time windows where we forecast important buying or selling opportunities.

- An Excel File with the 2024 Forecast Model

- Ongoing Updates during the year, usually every 2-3 months or whenever I think it is necessary.

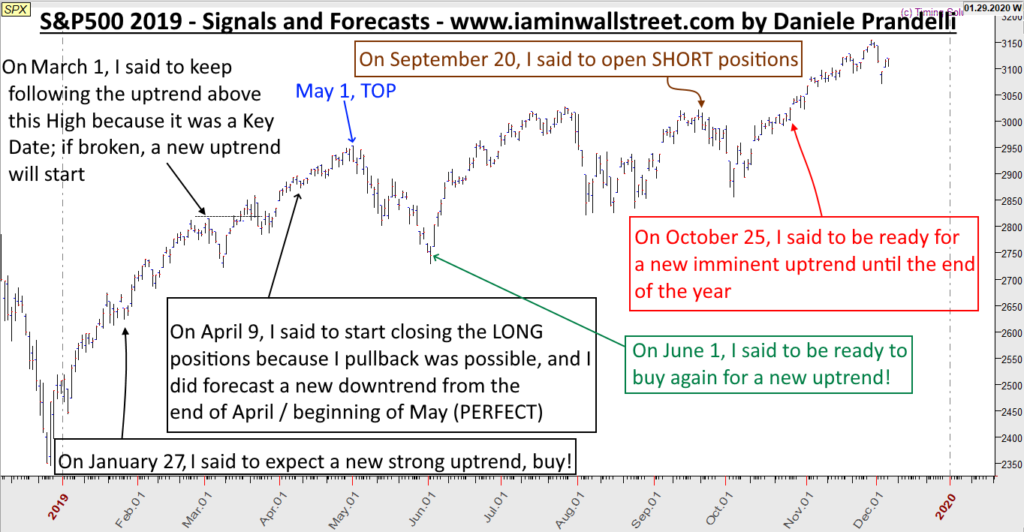

The best way to judge my work is to see how I have worked in the past. I share the correct and wrong calls. I am not here to say that I am infallible. Sometimes I am wrong, but history says that I am correct most of the time. Judge by yourself, here below.

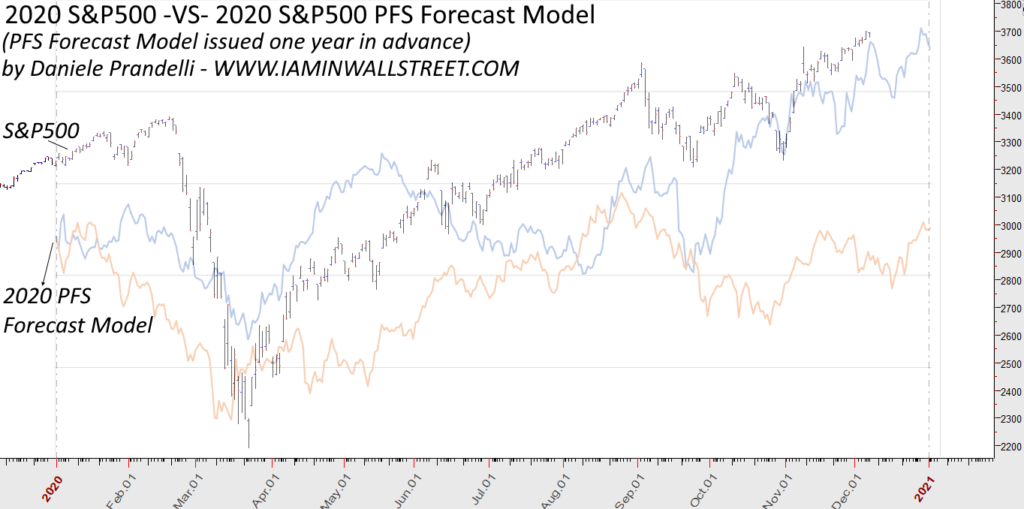

2023 S&P Forecast & Strategy Bulletin Review

The 2023 was a good year for us; the forecast covering the S&P500 worked perfectly in the first half of the year. We did forecast a Low in January and March, and then we did forecast a new uptrend exactly from March to mid-June, 2023.

You can see how both the projections were able to call a Low and buying opportunity in March 2023, precisely. The Orange line is usually my main guide, while the Blue line, which I call the short-term projection, is a secondary path. Usually, the forecast becomes very reliable when they work in sync.

In June, we were expecting the beginning of a new pullback until August; when we saw the August Low being broken in September, we said to wait for October 4-6, 2023, for a new buying opportunity, and then on October 27, 2023. You see how both the calls were correct, above all October 27, 2023, which we called as a buying opportunity right at the day. When the market deviates from the Orange line, usually the market takes a different momentary path, but then it tends to line up to the Orange line again, as it happened with the strong upswing started on October 27, 2023.

This is exactly what I wrote to my clients on October 27, 2023, through an Update, then judge by yourself:

“We are seeing a tough market, and I was not able to see it coming, to be honest, even if the breakout under the August Low could be a first signal of unexpected weakness. In the last Update, we mentioned October 3-6, which became a Low as we did forecast; we used it to buy, with the possibility to take some partial profits during the upswing, but in the last 10 days, new drop, moving even lower than October 4 Low. I am very angry because I was not expecting it at all, and in the last two months, my forecast has been failing! Nothing suggested to me this scenario right in these months.

Today, I am writing to you because I believe that today we have a new buying opportunity, a new Key Date that should create a Low for higher levels. I work with 4141 FP or 4197 FP (December Contract) to open LONG positions above them and use stop-loss orders under them. However, it is a delicate moment, maybe affected by the Middle East tension, I do not know! But sure, the Gold market turned very bullish because of that, and big funds may have dropped stocks for gold… just my supposition.

If the Market keeps dropping after Monday, I will probably remain FLAT, waiting for mid-November, when I have a new Key Date for a new trading opportunity.”

This Update was released the same very day of the Low, on October 27, 2023. You see when the market does something unexpected, we keep working with our timing analysis to find new opportunities. The Forecast Model provides a general path to follow, but then I send Updates to provide precise Key Dates to work with.

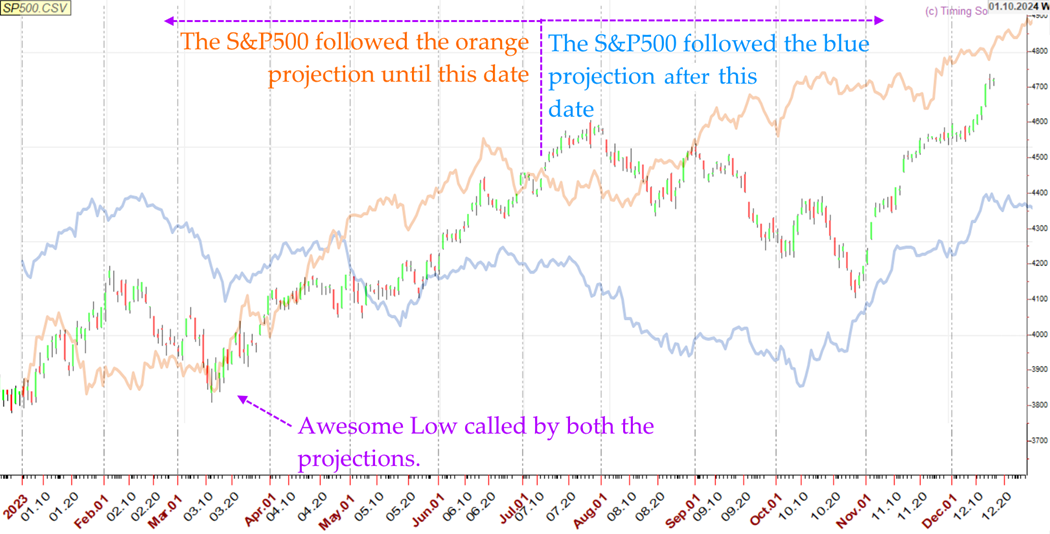

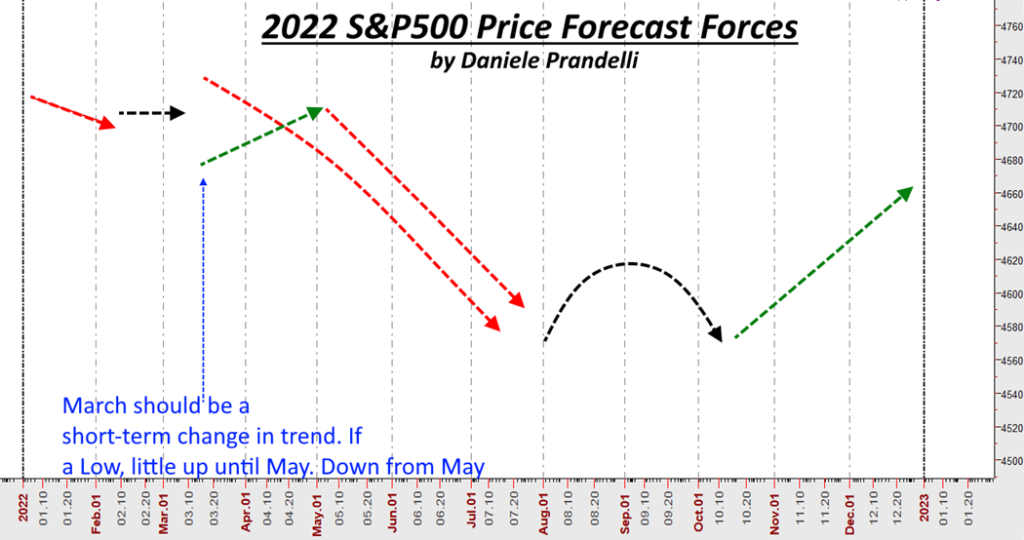

2022 S&P Forecast & Strategy Bulletin Review

Look at the 2022 S&P500 Forecast Model compared to the 2023 S&P500 market, below. Do I really need to explain it?!? I guess you can see with your own eyes that I was able to provide, again, a wonderful forecast, released one year in advance. Do you know that I said to SHORT under 4770-4800 points, in January 2022?

We did Forecast a downtrend from January 2022 to June/July, up until the end of August and down to October 2022 Low, and then up again. Ops, we did not make a mistake! And the 2022 Forecast was issued in December 2021.

In the 2022 S&P500 Forecast Bulletin, we also provided a clean chart to explain our expectations…

Here below is the Market compared to the Forecast Model:

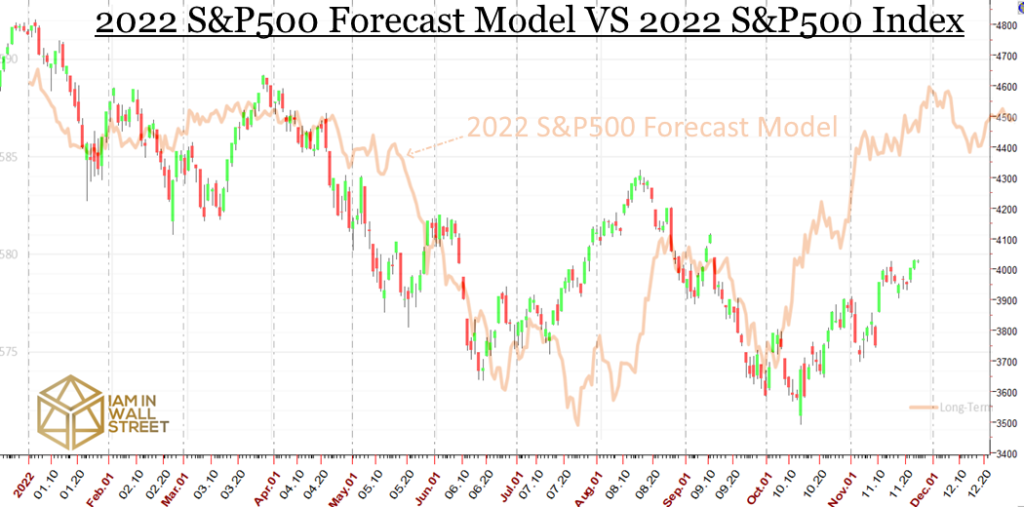

2020 S&P Forecast & Strategy Bulletin Review

We all know that 2020 was a controversial year. Look at how my 2020 Forecast Model forecasted perfectly the 2020 Low of the Year, after the crash due to COVID-19. I want to remind you that the forecast was released in December 2019:

The 2020 S&P500 Forecast Model has been able to forecast:

- The High and the Low of the year almost at the day (you do not believe it, but it is right there, in front of you, and if you have my Forecast Model course, you know that this is real, created in advance because you did it too, mathematically, without any discretionary choice)

- The descent from January/February to March 20-23

- The uptrend until December

The 2024 can be harder than expected…

If you do not trust my words, you should trust the facts:

- Watch my Activity Statements where I trade my forecasts and strategies

- Read the free Post I wrote on March 26, 2020

- Read my Comment on Linkedin, when I said that the Low was in, at the end of March 2020: https://www.linkedin.com/feed/update/urn:li:activity:6649162465454157824/?commentUrn=urn%3Ali%3Acomment%3A(activity%3A6649070798441111552%2C6649162363805188096)

- Read my amazing Comment on Linkedin, when I said that all the people were about to be wrong because they were very negative about the Market, it was the beginning of April 2020: https://www.linkedin.com/feed/update/urn:li:activity:6653785791824711680/?commentUrn=urn%3Ali%3Acomment%3A(activity%3A6653445638216392704%2C6653785668302446592)

I cannot cheat with Linkedin Comments!

The 2024 Forecast & Strategy Bulletin is now ready

I cannot promise anything because I am not here to tell you that I am infallible; I speak with my hard work, and you deserve it only if you spend time checking it. You can download all my entire 2019-2023 Bulletins and Updates that I have provided in the last years (it is a DropBox shared folder where you can download all the files of my Annual Bulletins). Read all and judge it. Take 30 minutes of your life and judge my work. It may save you in the future.

I have professional traders, managers from banks, and CEOs in the commodity industry who regularly order my work. Most of the time people do not subscribe to my work because they do not believe it is possible to do what I do. For this reason, I made available the entire work of the last years, covering all the Bulletins.

DOWNLOAD MY ORIGINAL 2019-2023 ANNUAL BULLETINS and UPDATES

You can download also the entire work covering Corn, Soybeans, Live Cattle, and Cotton.

What do you get ordering the 2024 S&P500 Forecast & Strategy Bulletin?

The Annual Forecast Model is based on the PFS forecast model, created by Daniele Prandelli to increase the probability of knowing in advance the most reliable trend. The PFS, linked with the Price Map, becomes a strong tool to be able to trade wisely, following the right trend and cutting immediately potential losses.

2024 Forces: a new chart where we show the favorite trend in different periods of the year; we have created this chart to better explain the phases of up pushes and down pushes; there are months of the year when a new movement should begin, and we know, most of the times, the right direction of these forces.

When we study the Annual Forecast, we have several time-windows where we can call Market situations with a high percentage of success; for example, sometimes we can predict which is the best month to buy or sell, or when we should expect the beginning of new up pushes. These time windows are summed up in the comment of the Annual Bulletin.

Our analysis or favorite scenario can change according to unexpected events and new Market conditions; for this reason, we send Updates over the year, summing up what we are expecting to see over the mid-term, updating the Price Map and the Forecast, with more precise details about the coming months.

Find out the 2024 S&P500 Forecast & Strategy Bulletin, to learn…

What’s next?

What are the most important supports and resistances we should look at?

What is my favorite scenario for the next months?

Is the downtrend about to begin or we are still in an uptrend?

What is the strategy we should use in the mid-term?

We provide all our answers in the 2024 S&P500 Bulletin

Judge by yourself my work; you can download all the 2019-2023 Annual Bulletins and Updates from our Archive

And remember: the Updates are the most important thing because we plan the strategy with the fresh cycles.

If you have any questions, please, do not hesitate to contact me.

REMIND THIS! – We do not believe in blind strategies based on forecasts; we use a specific strategy based on the Price Map we develop for each Market we trade. We follow our forecast, but only when it is supported by the Price Map.