- September 29, 2022

- Posted by: Daniele Prandelli

- Categories: Accounting, Forecast, S&P500

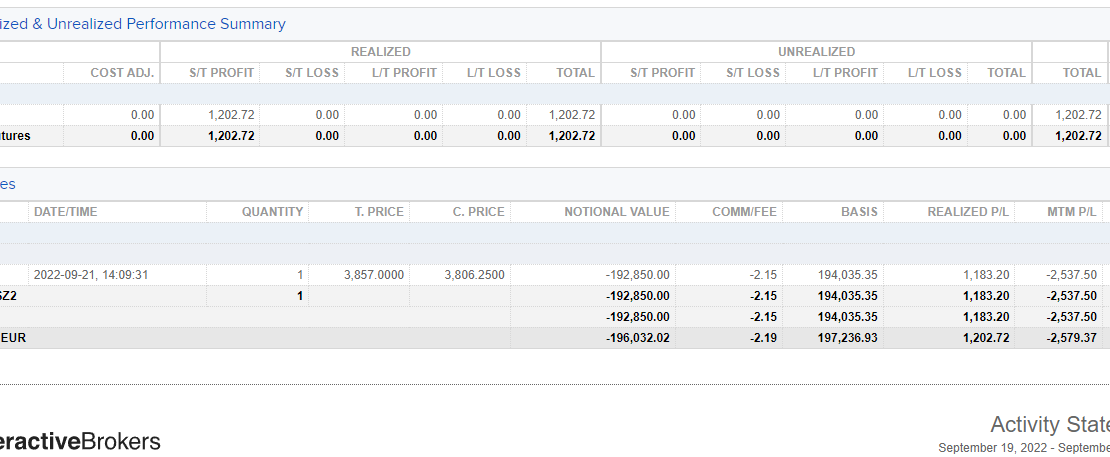

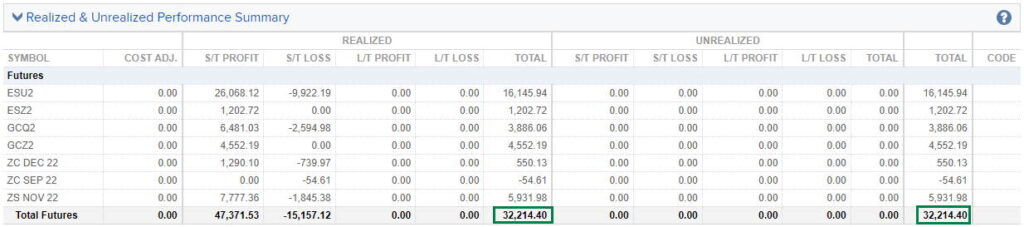

We continue to provide the Trades Record of real-time trades following the strategy provided by the Daily Report Service. We are doing it since July 18, 2022, with a profit of +32,214.40 EUR. Here below is the Performance Summary from July 18 to September 23, 2022:

It is so important to notice that we do have losses too! That’s trading, and we cannot trade without thinking to deal with losses too. All the trades have produced a profit of 47,371.53 and a loss of 15,157.12 EUR. As I always say, we work to make bigger profits than losses.

The Realized/Unrealized profit is the same because we ended up the week with no positions in the market.

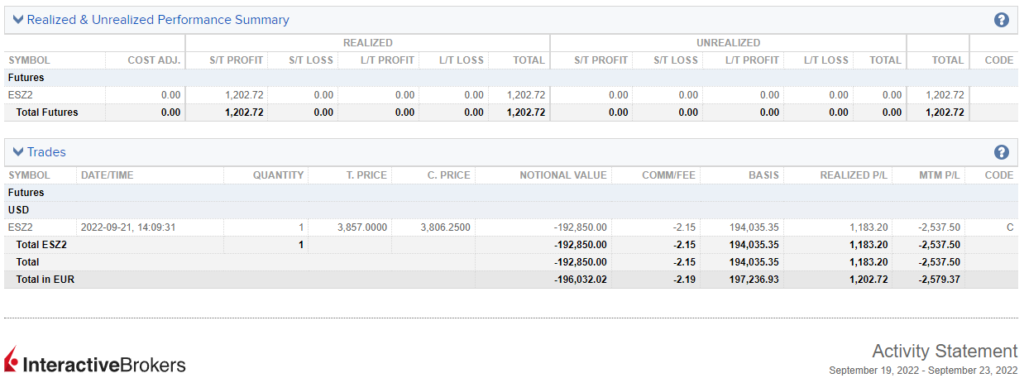

Here below is the only trade of the week; we closed the SHORT position at 3856 Futures Points (December Contract). I have been a little lazy during this week because the strategy said to close the position at 3836 points, plus, I missed a profitable trade with Soybeans too (a strategy that was provided to my Subscribers through the Daily Report).

If you look at the Trades Record of the week before, you see that we were SHORT from 4066.50 points with the September Contract, opened on September 9, 2022; we closed 1 contract in profit at 3940.75 points, and on September 16 we did the roll-over, moving from the September Contract to the December Contract. In one week, we took a profit of over 200 points. All my Subscribers know that I planned to see this downtrend in advance (indeed, you can find it in my 2022 S&P500 Bulletin, written in December 2021). Boom!

Is this Stock Market downtrend over?

Some people may think that I closed the SHORT position because I am expecting to see a new imminent uptrend. Nope! I had a possible short-term up-push, but it did not work (no losses were taken anyway). I think we are still a little far from a potential, new, safe buying opportunity. I have already shared with my clients my favorite timing for the next BUY.

During this week, I started a new trade that I consider potentially good, and it is not about the S&P500. You will see next week what market I am talking about… unless you want to know it now as a Subscriber.